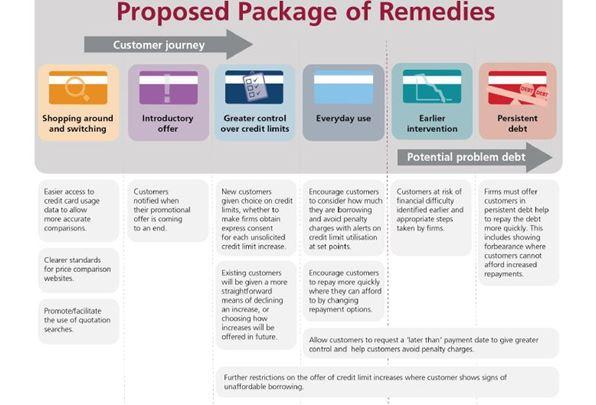

Following the findings of the credit card market study (MS14/6)[1], the FCA has launched a consultation paper (CP17/10) on persistent debt and earlier intervention remedies. In its earlier credit card market study the FCA found that competition was working fairly well for most credit card customers. They had, however, significant concerns about the scale, extent and nature of problem credit card debt and firms’ limited incentives to reduce this. Alongside the matters under consultation the FCA also set out details of an industry voluntary agreement to give customers more control over credit limit increases.

Persistent debt

The proposals on persistent debt are designed to work together with existing rules on forbearance under CONC 7.3.4R[2] and the FCA’s earlier intervention rules. Where the customer is already being treated in an equivalent or more favourable way than would be the case under the persistent debt rule, the requirement to notify customers about the 18, 27 or 36 month intervention would not apply.

The FCA proposes that the definition of ‘persistent debt’ is that where customers are paying more in interest and charges than principal over an 18 month period.

At 18 months. Customers are to be informed that:

- increasing their current rate of repayments would reduce their cost of borrowing and the time taken to repay

- continuing low repayments for another 18 months may lead to the firm suspension of the card and referring the matter to a credit reference agency.

At 27-28 months. If customers’ repayments up to this point indicated the likelihood that they were to remain in persistent debt at the 36 month mark, firms are required to repeat the steps required at 18 months.

At 36 months. If customers are still in persistent debt after a further 18 months, having thus repaid more in interest and charges than principal for two consecutive 18 month periods, firms must take steps to help customers repay the outstanding balances more quickly:

- firms must write to the customer proposing repayment plans based on repaying over a reasonable period[3]

- the customer will be made aware that not engaging with the firm would lead to suspension of the card

- firms must exercise forbearance to assist the customer to repay the debt more quickly[4] where the customer informs the firm that they cannot afford any of the proposed payment option <br/> <br/>where forbearance is shown, the FCA expects that it will be necessary for the firm to suspend the use of the card<br/>

- customers who can afford the payment options but decline to do so or customers who do not respond to the firm would have their card suspended/cancelled

This intervention will continue until the customer has repaid the balance they had at 36 months.

Earlier intervention

The FCA proposes new high-level requirements in CONC to require earlier intervention. These proposals will not affect CONC 6.7.2R[5] with respect to all other forms of consumer credit lending.

The full draft rules are set out in Annex 1 of the consultation. In summary:

- credit card firms will be required to monitor a customer’s repayment record and any other relevant information[6] that the firm holds to identify signs of actual or possible financial difficulties

- firms must take appropriate action where there are such signs, and

- firms must establish, implement and maintain an adequate policy for identifying and dealing with customers showing signs of actual or possible financial difficulties[7], even though they may not have missed a payment.

In addition to the current guidance in CONC 6.7.3G[8] on actions to be taken by firms where it has identified that a customer is showing signs of actual or possible financial difficulties, the FCA outlines further potential actions a firm may consider:

- suspending, reducing, waiving or cancelling any further interest or charges

- accepting token payments for a reasonable period of time in order to allow a customer to recover from an unexpected income shock

- notifying the customer of the risk of escalating debt, additional interest or charges and of potential financial difficulties

- providing the contact details for not‑for‑profit debt advice bodies and encouraging the customer to contact one of them[9].

Control over credit limit increases

The industry agreed[10] voluntary remedies, which when adopted, will give customers greater control over their credit limit. The agreement will operate in the context of existing obligations on firms in relation to credit limit increases (such as CONC 6.2.1(R)(1)(b)[11] and CONC 6.7.7(R)[12]). The agreement sets out:

- all new customers will be given the choice of how credit limit increases will be applied to their account

- existing customers will be offered an easier way to decline an offer of a credit limit increase and would be given the choice of having any future offers on an opt-in basis

- all customers will be informed of their right to no longer receive credit limit increase offers

- all customers will have the right to ask for a credit limit increase at any time

There will also be changes to the way in which firms offer unsolicited credit limit increases (UCLIs) to customers who are making systematic minimum payments:

- customers will not receive a credit limit increase following 8 months of making minimum repayments unless they opt in and other conditions[13] are met

- customers will no longer receive UCLIs following 14 months of minimum repayments

- where customers have high credit utilisation over an extended length of time, firms will not be permitted to increase the limit of a customer without the customer’s express consent.

The timelines for the industry agreement remedies:

- promotional rate expiry: April 2018

- payment date changes: April 2018

- close to credit limit prompt: July 2018

The first two remedies will have an interim implementation rate of 95% in January 2018.

Next steps

The consultation closes on 3 July 2017. The FCA is expected to publish a Policy Statement and Handbook changes later in 2017.

[1] One of the key findings was that 650,000 people had been in persistent debt for three years or more, and a further 750,000 people had been making systematic minimum repayments for that time.

[2] A firm must treat customers in default or in arrears difficulties with forbearance and due consideration.

[3] Usually over the course of 3 to 4 years.

[4] The nature of forbearance, where required, is not prescribed but may include reducing/waiving/cancelling any interest or charges to the extent that the customer is able to repay their balance in a reasonable period.

[5] A firm must monitor a customer's repayment record and take appropriate action where there are signs of actual or possible repayment difficulties.

[6] Such as drawdown behaviour, credit reference agencies’ data (e.g. credit scores), and data from other credit products held with that firm.

[7] Signs of actual or possible financial difficulties include where there is a significant risk of one or more of the following matters are set out in CONC 1.3.1G.

[8] The action referred to in CONC 6.7.2 R should generally include:

(1) notifying the customer of the risk of escalating debt, additional interest or charges and of potential financial difficulties; and

(2) providing contact details for not-for-profit debt advice bodies.

[9] This latter element goes further than the similar provision for non credit cards.

[10] Ongoing monitoring of the industry agreement will be overseen by the Lending Standards Board.

[11] Before significantly increasing:

(b) a credit limit for running-account credit under a regulated credit agreement;

the lender must undertake an assessment of the customer's creditworthiness.

[12] A firm must not increase, nor offer to increase, the customer's credit limit on a credit card or store card where:

(1) the firm has been advised that the customer does not wish to have any credit limit increases; or

(2) a customer is at risk of financial difficulties.

[13] Such as credit worthiness assessment.

Social Media cookies collect information about you sharing information from our website via social media tools, or analytics to understand your browsing between social media tools or our Social Media campaigns and our own websites. We do this to optimise the mix of channels to provide you with our content. Details concerning the tools in use are in our privacy policy.